ZIMEC Knowledge Partner Insights – NewCo Mining Consultancy

NewCo specializes in providing consultancy services tailored for the mining industry across Zambia and the broader African region.

The firm embodies a synergy of "Local Knowledge, Global Experience, and Expertise," rooted in the rich mining heritage of the Katanga region, extending from the Democratic Republic of Congo’s Katanga province to Zambia's Copperbelt and Northwestern provinces.

A Global Self-Regulatory Forum in the Mining Sector, an Enhancement for Attracting Investment

Energy transition metals are key to achieving green energy and digital transformation. According to BHP, global copper demand will grow by around 70% to over 50 million tonnes (Mt) a year by 2050. They assert that demand will be driven by the ‘Energy Transition’ and ‘Digital’ trends. There is a looming global copper supply challenge as existing copper mines age, with the pipeline of potential projects less healthy than in previous cycles.

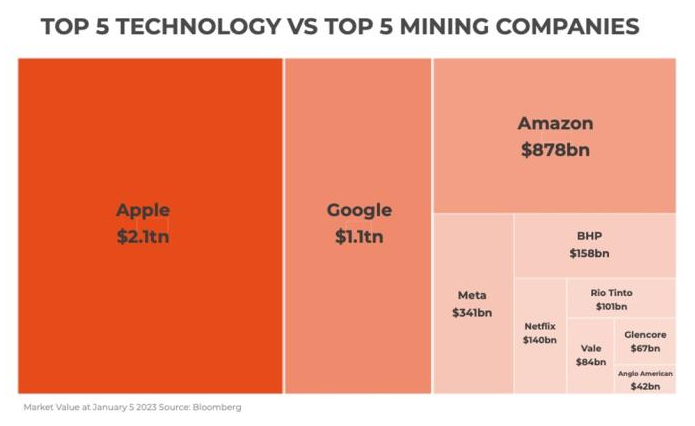

Inspite of all this optimism about energy transition metals, mining’s market capitalisation is dwarfed by the high-tech companies. (See Figure 1). Mining remains unattractive to investors. It is perceived as environmentally destructive, has a perception of rent extraction, risky and prone to stocking armed conflicts in Africa.

Figure 1: big-mining-vs-big-tech-relative-market-cap in January 2023. Source: mining.com

Several disputes have been reported between mining houses and their host governments, the latest one being between Barrick and the Malian government. Such conflicts reinforce the perception of inequitable rent extraction for distant shareholders.

There is a danger that more governments may take Mali’s approach in varying degrees of severity. This could lead to more problems in attracting finance for an already troubled industry that is deemed to be too risky.

Governments and the Mining Industry

Governments are often accused of being greedy and making unsubstantiated claims. Companies are, in turn, accused of making deals with individuals, often outside of the law to avoid paying taxes to national treasuries. Ultimately, these disputes raise the risk profile for investors. Chief among them is the loss of tenure of mining licenses. Sovereign and regulatory risks cannot be overlooked. The industry cannot continue to ignore these recurrent problems but must endeavour to establish robust, transparent and fair mechanisms to manage them.

Environmental and Social Governance (ESG)

According to Maybee et al, companies face increasing pressure from investors, customers and regulators to address, monitor and manage Environmental, Social and Governance (ESG) risks.

Common ESG risks encompass:

- Climate change impact mitigation.

- Environmental practices and duty of care.

- Respect for human rights.

- Anti-bribery and corruption practices.

- Board composition and effectiveness.

- Compliance with relevant laws and regulations.

Need for a Self-Regulatory Forum

Inspite of identifying these risks, the current approach is largely reactive – addressing the problem by seeking arbitration after the conflict has occurred rather than robust preventive measures.

It would be better to establish a mechanism where demands and/or requests that are outside of a country’s mining code are reported to and objectively addressed under a self-regulatory forum.

NewCo proposes the creation of a mining and minerals self-regulatory body to which companies and governments will be members. Any irregular payments made or incentives given outside the jurisprudence of this body will leave participants unprotected and liable for sanctions in their various countries.

Benefits of Self-Regulatory Forums

- Maintain public trust.

- Promote innovation.

- Enhance industry reputation.

- Reduce/share the regulatory burden.

- Foster collaboration.

Challenges and Limitations

- Conflict of interest.

- Lack of enforcement power.

- Inconsistent standards.

- Limited scope.

Overall, self-regulatory forums can be an effective way to promote industry standards and best practices.

Conclusion

NewCo proposes a voluntary, self-regulating mechanism overseeing ALL ESG ASPECTS including but not limited to, environment, respect for human rights, anti-bribery and corruption practices, aversion of conflict minerals as well as compliance to relevant laws and regulations.

This will help the mining sector shed its problematic image and hopefully attract capital commensurate with the vision that transition metals are poised to play in the global economy.